India's largest public sector lender, the State Bank of India (SBI) on Thursday reported an impressive 84.32 per cent surge in net profit (year-on-year) at Rs 16,891 crore for the October-December quarter (Q3 FY25), from Rs 9,164 crore in the year-ago period.

Category: personal-finance

UPI processed Rs 81 lakh cr worth transactions in April-July, up 37 pc YoY

Surpassing world’s leading digital payments platforms, India’s Unified Payments Interface (UPI) processed nearly Rs 81 lakh crore transactions in the April-July period this year, which is a staggering 37 per cent increase (year-on-year).

Direct tax collections shoot past budget target by Rs 1.35 lakh cr in 2023-24

The net direct tax collections, comprising corporate tax and personal income tax shot up to Rs 19.58 lakh crore in 2023-24, compared to Rs 16.64 lakh crore in the preceding financial year, representing a double-digit increase of 17.7 per cent.

India’s retail inflation eases to 5.1% in Jan

India’s retail inflation slowed to 5.1 per cent in January this year from 5.69 per cent in December 2023, bringing some relief to household budgets, according to official figures released on Monday.

RBI bulletin ups India's GDP growth forecast to 7% for Oct-Dec quarter

India’s economic activity remained resilient on the back of robust domestic demand, notwithstanding the external headwinds. Supply chain pressures in India ebbed in December and remained below historical average levels, according to the RBI’s monthly bulletin released on Thursday.

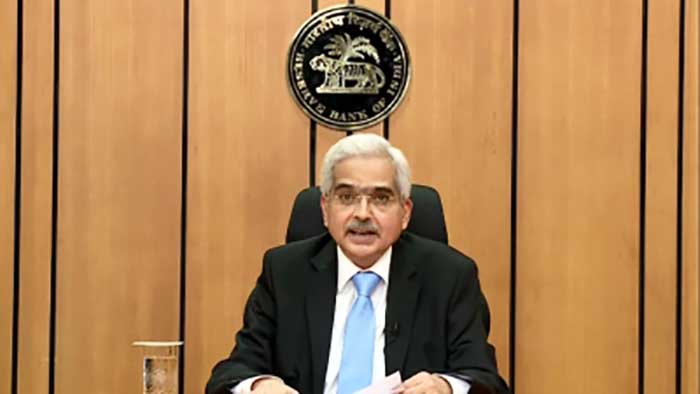

Customer benefits being kept in mind while regulating Fintechs: RBI Guv

Reserve Bank of India (RBI) Governor Shaktikanta Das said on Thursday that post-pandemic digital lending has seen an exponential rise in India and at the same time, it has also raised a host of business conduct issues on which the central bank was keeping a close watch.

RBI hikes limits for UPI payments & e-mandates, to set up cloud facility, FinTech repository

Enhancing the payment limits for Unified Payments Interface (UPI), electronic mandates, setting up of cloud facilities, the financial sector and fintech repository were some of the major announcements made by the Reserve Bank of India Governor, Shaktikanta Das on Friday.

RBI doubles gold loans limit to Rs 4L for UCBs under bullet scheme

The Reserve Bank of India (RBI) on Friday announced an increase in the monetary ceiling of gold loans that can be granted under the bullet repayment scheme from Rs 2 lakhs to Rs 4 lakhs for urban co-operative banks (UCB) who have met the overall PSL target and sub targets as on March 31, 2023.

Price of tomatoes, chilli heated up veg and non-veg thalis by 34%, 13% in July

The cost of preparing a vegetarian thali at home has gone up by 34 per cent while that of a non-vegetarian thali went up by 13 per cent in July as compared to the input prices that prevailed in June 2023, CRISIL said in a report.

Domestic investors holding declined in June quarter

According to Pranav Haldea, Managing Director, Prime Database Group, this was on account of profit booking by LIC, mutual funds as also retail and HNI investors with markets reaching all-time highs. Net inflows from DIIs stood at just Rs 3,368 crore during the quarter.

India's geopolitical position can give tailwinds for economic growth: S&P Global Ratings

India's economic growth efforts could get the tailwinds from its geopolitical position, said S&P Global Ratings in a report on the country's quest for stable and high economic growth.

Economic growth should be 7.6% annually in next 25 years for India to become developed economy: RBI report

According to the central bank's monthly bulletin, which was released on Monday, India's per capita income is currently estimated at $2,500, while it must be more than $21,664 by 2047, as per World Bank standards, to be classified as a high-income country.

GST collections rise 3% in June to Rs 1,61,497 crore

Out of the GST collected in June, CGST was Rs 31,013 crore, SGST was Rs 38,292 crore, IGST was Rs 80,292 crore (including Rs 39,035 crore collected on import of goods) and cess Rs 11,900 crore (including Rs 1,028 crore collected on import of goods).

Canada's CPI rose 3.4% in May

Statistics Canada said on Tuesday this was the smallest increase since June 2021 and the slowdown was largely driven by lower year-over-year prices for gasoline resulting from a base-year effect, Xinhua news agency reported.

RBI MPC retains repo rate at 6.5%, projects 6.5% GDP & 5.1% inflation for FY24

Not belying the expectations, the Reserve Bank of India's Monetary Policy Committee (MPC) did not change the repo rate from 6.50 per cent while projecting gross domestic product (GDP) and inflation at 6.5 per cent and 5.1 per cent respectively.

India's GDP growth in FY23 estimated at 7.2%

India's gross domestic product (GDP) growth for FY23 is estimated at 7.2 per cent, said the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation on Wednesday.

Rs 2K note withdrawal won't increase gold demand or affect rupee value

The decision of the Reserve Bank of India (RBI) to withdraw Rs 2,000 denomination banknotes from circulation will not have any major impact on gold demand and also on the rupee value, experts said on Saturday.