Global credit rating agency Fitch Ratings on Tuesday said that Indian banks' exposure to the Adani group do not present any major risk to the banks' standalone credit profiles.

In a statement issued the credit rating agency said: "Fitch Ratings believes that Indian banks' exposure to the Adani group is insufficient in itself to present substantial risk to the banks' standalone credit profiles. Indian banks' Issuer Default Ratings (IDRs) all remain driven by expectations that the banks would receive extraordinary sovereign support, if needed."

On February 3, 2023, Fitch Ratings said that the controversy over the short-seller report has no immediate impact on the ratings of Fitch-rated Adani entities and their securities.

"Even under a hypothetical scenario where the wider Adani group enters distress, exposure for Indian banks should, in itself, be manageable without adverse consequences on the banks' Viability Ratings," Fitch Ratings said.

Citing the State Bank of India's (SBI) information on February 3 that the government owned banks' share of loans to Adani Group loans had fallen to 31 per cent by end-2022, from 55 per cent in 2016.

"We believe loans to all Adani group entities generally account for 0.8 per cent - 1.2 per cent of total lending for Fitch-rated Indian banks, equivalent to 7 per cent - 13 per cent of total equity," Fitch Ratings said.

According to Fitch Ratings, even in a distress scenario, it is unlikely that all of this exposure would be written down, as much of it is tied to performing projects.

Loans involving projects still under construction and those at the company level could be more vulnerable. However, even if exposures were fully provisioned for, we do not expect it would affect banks' Viability Ratings, as banks have sufficient headroom at their current rating levels, Fitch Ratings said.

On the banks holding some unreported non-funded asset exposure, such as commitments or through holdings of Adani group bonds or equity, particularly as collateral Fitch Ratings said those could be small and may not be material for its rated banks.

However, Fitch Ratings said the government owned banks could face pressure to provide refinancing for Adani Group companies if foreign banks scale back their exposure or investor appetite for the group's debt weakens in global markets.

"This could affect our assessment of the risk appetite of such banks, particularly if not matched with commensurate building of capital buffers. However, such a scenario would underpin the quasi-policy role of state-owned banks and reinforce our sovereign support expectations," Fitch Ratings added.

These effects could be amplified if the controversy heightens financing challenges for other Indian corporates, increasing their reliance on local bank borrowings. Nonetheless, India's corporate sector has generally deleveraged in recent years, reducing its exposure to refinancing risk.

Fitch Ratings said the economic and sovereign implications of the Adani controversy remain limited. However, there is a tail risk that fallout from the controversy could broaden and influence India's sovereign rating, with knock-on effects for bank IDRs.

"When we affirmed the sovereign's rating at 'BBB-' with a Stable Outlook in December 2022, we stated that a structurally weaker growth outlook that weighs further on India's debt trajectory could lead to negative rating action," said Fitch Ratings.

The Adani group plays an important role in India's infrastructure construction sector. Infrastructure development may slow, curbing India's sustainable economic growth rate, if its ability to contribute to the government's infrastructure rollout plans is impaired, though we believe the impact on growth would be likely to be small.

The country's medium-term economic growth could also be hurt if the group's troubles have substantial negative spill-overs to the broader corporate sector or significantly raise the cost of capital for Indian firms, dampening investment.

Nonetheless, we still view the underpinning of India's robust growth outlook as sound and that such risks are low, Fitch Ratings said.

Tripura CM Saha holds key meeting with BJP, IPFT and TMP leaders

Tripura Chief Minister Manik Saha on Friday held an "important" meeting between the leaders of ruling BJP and its two allies – Tipra Motha Party (TMP) and Indigenous People's Front of Tripura (IPFT) and discussed various political and developmental issue, sources said.

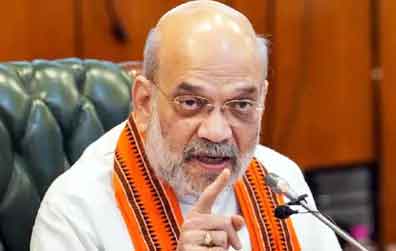

HM Amit Shah's meeting sends a clear message: Not a drop of water to Pakistan

A high-level meeting was held on Friday at the residence of Union Home Minister Amit Shah regarding the suspension of the Indus Waters Treaty. The 45-minute meeting between the Home Minister and Union Jal Shakti Minister C.R. Patil focused on exploring ways to halt the flow of water to Pakistan.

Tripura: TMP chief urges Centre to adopt 'stronger policy' against B'desh

Ruling BJP’s ally Tipra Motha Party (TMP) founder-chief Pradyot Bikram Manikya Debbarma on Friday urged the Central government to adopt a stronger policy stance towards Bangladesh, accusing the neighbouring country of encouraging fundamentalist forces targeting Hindu minorities.

Pahalgam attack: More countries express solidarity with India, offer support in fight against terrorism

Ambassadors of Israel, Egypt, Argentina, and Nepal met External Affairs Minister (EAM) S. Jaishankar in New Delhi on Friday, expressing solidarity with India in its fight against terrorism following the heinous terror attack in Pahalgam.

Tripura CM directs SPs and DMs to remain vigilant about Pakistani nationals

Tripura Chief Minister Manik Saha on Friday directed the Superintendents of Police (SPs) of all eight districts to regularly share necessary inputs with the Chief Minister’s Secretariat regarding the presence of any Pakistani nationals in the state, officials said.

US supports India's 'hunt' for those behind 'horrific Islamist terrorist attack' in Pahalgam, says Gabbard

Tulsi Gabbard, Director of National Intelligence (DNI), on Friday said that the United States supports India's "hunt" for the perpetrators of the "horrific Islamist terrorist attack" in Pahalgam that took place earlier this week.

Tehran stands ready to 'forge greater understanding' between India and Pakistan: Iran FM Araghchi

Citing its good relations with both India and Pakistan, Iran on Friday said that it stands ready to "forge greater understanding" between New Delhi and Islamabad following the Pahalgam terror attack, earlier this week.

PM Modi's action will act as deterrent against any fresh attempts to harm India: Tripura CM

Tripura Chief Minister Manik Saha on Friday denounced the Pahalgam terror attack, asserting his staunch belief that Prime Minister Narendra Modi's decisive action will act as a strong deterrent against any future attempts by terrorists to harm India.