Gold Exchange Traded Funds (ETFs) attracted massive investments in FY 2025, with net inflows of Rs 14,852 crore -- nearly three times higher than the Rs 5,248 crore recorded in FY 2024, according to the data released by the Association of Mutual Funds in India (AMFI) on Friday.

The sharp surge in inflows reflects rising investor preference for safe-haven assets amid global economic uncertainty, persistent inflation, and escalating geopolitical tensions.

According to the AMFI, the rally in international gold prices and the weakening of major global currencies against the US dollar further strengthened the appeal of gold as a portfolio diversifier during the financial year.

The overall trend for FY25 shows that gold remains a trusted hedge against market volatility and macroeconomic risks.

With uncertainty still looming over the global economy, experts believe Gold ETFs will continue to be an important part of diversified investment portfolios.

Meanwhile, the mutual fund industry as a whole showed strong performance in March 2025. The total net Assets Under Management (AUM) stood at Rs 65.74 lakh crore, up from Rs 64.53 lakh crore in February.

The average AUM (AAUM) for March was Rs 66.70 lakh crore. Retail participation in mutual funds also grew steadily, with the number of folios touching 23.45 crore in March.

Out of this, retail investors in equity, hybrid, and solution-oriented schemes accounted for over 18.58 crore folios.

Retail AUM in these segments rose to Rs 38.83 lakh crore, up from Rs 36.44 lakh crore in February.

March 2025 also marked the 49th straight month of positive equity inflows, a trend that began in March 2021. Equity-oriented schemes saw inflows of Rs 25,082 crore in the month.

Systematic Investment Plans (SIPs) continued to gain traction, with over 40.18 lakh new SIPs registered in March.

The total number of active SIP accounts stood at 8.11 crore, contributing Rs 25,925 crore to the mutual fund industry. The SIP AUM reached Rs 13.35 lakh crore by the end of the month.

In addition, 30 new open-ended schemes were launched in March across various categories, collectively raising Rs 4,085 crore, the AMFI said.

Seven cops injured during anti-Waqf Act rally in Tripura

At least seven policemen sustained injuries on Saturday during a clash between the security personnel and the agitators who held a protest rally against the recently enacted Waqf (Amendment) Act in northern Tripura’s Kailashahar under Unakoti district.

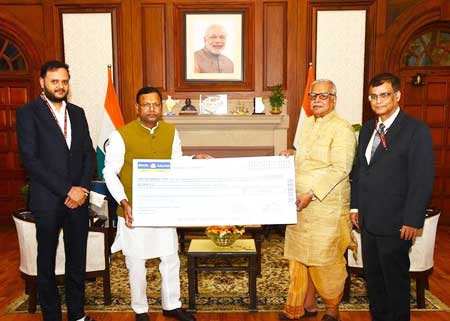

Rose Valley Ponzi scam: Centre hands over Rs 515 crore to help 7.5 lakh victims

The government on Saturday handed over Rs 515.31 crore to Justice D.K. Seth (Retd), Chairman of the Asset Disposal Committee which was formed for the purpose of restitution of properties to legitimate investors in the Rose Valley Ponzi scam.

Chhattisgarh: Heavy loss to Maoists in Bijapur-Dantewada, encounter going on

Heavy loss to Maoists have been reported in the Bhairamgarh area, located on the Bijapur-Dantewada border in Chhattisgarh, during an encounter between security forces and Maoists on Saturday.

Om Birla brings 'Mayra' to martyr’s home fulfilling promise to sister on her daughter's wedding

Six years after the martyrdom of CRPF Jawan Hemraj Meena in the Pulwama attack, a wave of joy swept through his home on Saturday as the courtyard of Veerangana (war widow) Madhubala was filled with the sounds of celebration and music as the family prepared for her daughter’s wedding.

'Should Hindus leave Bengal?' asks Giriraj Singh, slams Mamata Banerjee govt over Murshidabad violence

Union Minister Giriraj Singh on Saturday strongly condemned the recent violence in West Bengal’s Murshidabad district, calling it a "heart-wrenching" incident that reflects the deteriorating law and order situation under the Mamata Banerjee-led government.

U'khand tragedy: Car with Haridwar family plunges into Alaknanda River; one rescued, five feared dead

In a heartbreaking incident near Devprayag, Uttarakhand, a car carrying a family from Haridwar plunged into a 300-metre-deep gorge and sank into the Alaknanda River near the Badshah Hotel area on Saturday.

US orders foreign nationals to register under Alien Act or face arrest, deportation

In a sweeping move that has ignited concern among immigrant communities across the United States, the White House has announced that all foreign nationals residing in the country for over 30 days must register with the federal government or face strict penalties, including fines, imprisonment, and deportation.

JCO killed as Army foils infiltration bid on LoC in J&K

A Junior Commissioned Officer (JCO) of the Indian Army was killed when alert soldiers foiled an infiltration bid on the Line of Control (LoC) in Jammu and Kashmir's (J&K’s) Akhnoor sector, officials said on Saturday.