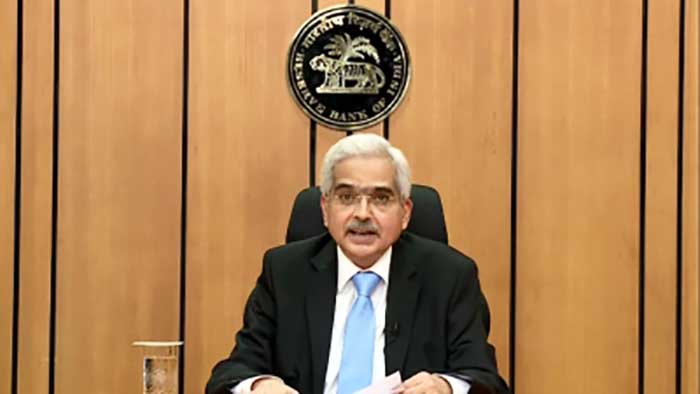

Enhancing the payment limits for Unified Payments Interface (UPI), electronic mandates, setting up of cloud facilities, the financial sector and fintech repository were some of the major announcements made by the Reserve Bank of India Governor, Shaktikanta Das on Friday.

Das announced these measures on Friday after declaring the Monetary Policy Committee’s decision to retain the repo rate at 6.5 per cent and predicting the gross domestic product (GDP) growth rate at 7 per cent and inflation rate at 5.4 per cent for FY24.

“To encourage the use of UPI for medical and educational services, it is proposed to enhance the limit for payments to hospitals and educational institutions from Rs1 lakh to Rs 5 lakh per transaction. Separate instructions will be issued shortly,” he said.

According to Das, the UPI is becoming popular and the transaction limit was set at Rs 1 lakh barring categories like Capital Markets (AMC, Broking, Mutual Funds and others), Collections (Credit card payments, Loan repayments, EMI), Insurance and others where the transaction limit was set as Rs 2 lakh.

In December 2021, the transaction limit for UPI payments for Retail Direct Scheme and for IPO subscriptions was increased to Rs 5 lakh.

As regards the electronic mandates, Das also said the RBI has decided to exempt the additional factor of authentication (AFA) for transactions up to Rs 1 lakh for the following categories, viz., subscription to mutual funds, payment of insurance premium and payments of credit card bills.

The other existing requirements such as pre- and post-transaction notifications, opt-out facility for users, etc., shall continue to apply to these transactions.

The RBI Governor said the number of electronic mandates registered currently stands at 8.5 crore, processing nearly Rs 2,800 crore of transactions per month.

In order to ensure the security, integrity and privacy of financial sector data, the RBI has decided to set up a cloud facility for the sector and will be operated by Indian Financial Technology & Allied Services (IFTAS) a wholly-owned subsidiary of RBI.

“Eventually, the cloud facility will be transferred to a separate entity owned by the financial sector participants. This cloud facility is intended to be rolled out in a calibrated fashion in the medium term,” Das said.

He said banks and financial entities are maintaining an ever-increasing volume of data utilising various public and private cloud facilities.

Similarly, for better understanding of the developments in the FinTech ecosystem with an objective to appropriately support the sector, Das said it is proposed to set-up a Repository for capturing essential information about FinTechs, encompassing their activities, products, technology stack, financial information and others.

FinTechs would be encouraged to provide relevant information voluntarily to the Repository which will aid in designing appropriate policy approaches. The Repository will be operationalised by the Reserve Bank Innovation Hub in April 2024 or earlier.

2 killed, 6 injured in US university shooting

Two people were killed and six others were injured after an active shooter opened fire on the Florida State University (FSU) campus in Tallahassee on Thursday, law enforcement said at a news conference.

DoNER Minister bats for accelerating the Special Economic Zone in Manipur

Union Development of North Eastern Region (DoNER) Minister Jyotiraditya Scindia on Thursday directed officials to accelerate the pace of key infrastructure projects, including universities, Information Technology and Special Economic Zone in Manipur, mental, maternity and child hospital, officials said.

Notorious drug mafia Ripon Mia held in Boxanagar

In a major breakthrough in the fight against narcotics, the notorious drug mafia Ripon Mia was arrested today evening in a successful joint operation by the police and Tripura State Rifles (TSR) in Veluachar Dayalpara under Boxanagar's Kalamchoura police station.

Bangladeshi national, three touts held in Agartala

In a coordinated operation aimed at curbing illegal cross-border activity, four individuals — including a Bangladeshi national — were apprehended by security forces at Agartala Railway Station on Wednesday evening.

Biplab slams oppositions for vote bank politics over Waqf Act

Lok Sabha MP and former Chief Minister Biplab Kumar Deb on Thursday launched a sharp attack on opposition parties—Trinamool Congress, Congress and CPI(M)—accusing them of spreading deliberate misinformation regarding the Waqf (Amendment) Act, 2025.

New Act enacted to curb Waqf misuse, claims Tripura CM

Tripura Chief Minister Manik Saha on Thursday said that the Waqf (Amendment) Act 2025 has been passed in the Parliament, aiming to address allegations of misuse of Waqf properties by a section of leaders, misuse of Section 40, land grabbing, and other corruption.

DoNER Ministry facilitate in unlocking Manipur’s growth: Scindia

Union Development of North Eastern Region (DoNER) Minister Jyotiraditya Scindia on Thursday said that he is confident that his ministry would serve as a proactive facilitator in unlocking new opportunities and accelerating Manipur’s growth and development.

Bengal school jobs row: SC allows 'untainted' teachers to continue till fresh selection is over

The Supreme Court on Thursday allowed the "untainted" assistant teachers in West Bengal, whose appointments were cancelled due to large-scale irregularities in the 2016 selection process, to continue in their positions till fresh recruitment is completed.